In this article you will learn more about depreciations and how to add depreciations to specific Capex items.

In order to capture different depreciations, you must create detailed investment costs and add the desired depreciation to the respective cost items.

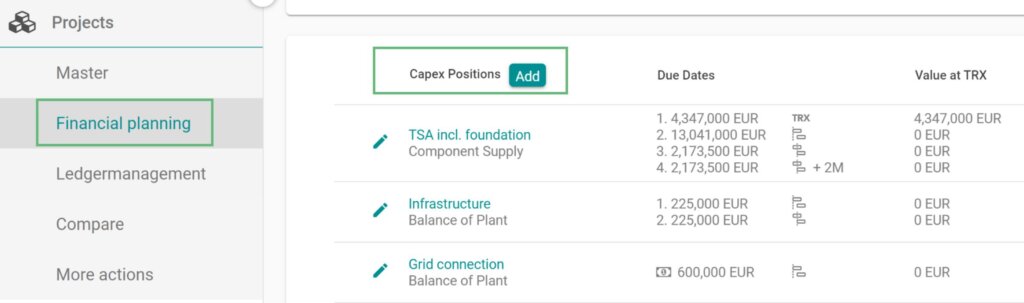

- If you have not yet captured any Capex items, you can do this by clicking on “Add investment cost position” in the Capex section. You can add the desired depreciation to each newly created capex item separately.

Info: As soon as Capex items are added, the depreciation in the “Asset” box applies only to the residual. If you would like to know more about the residual, click here.

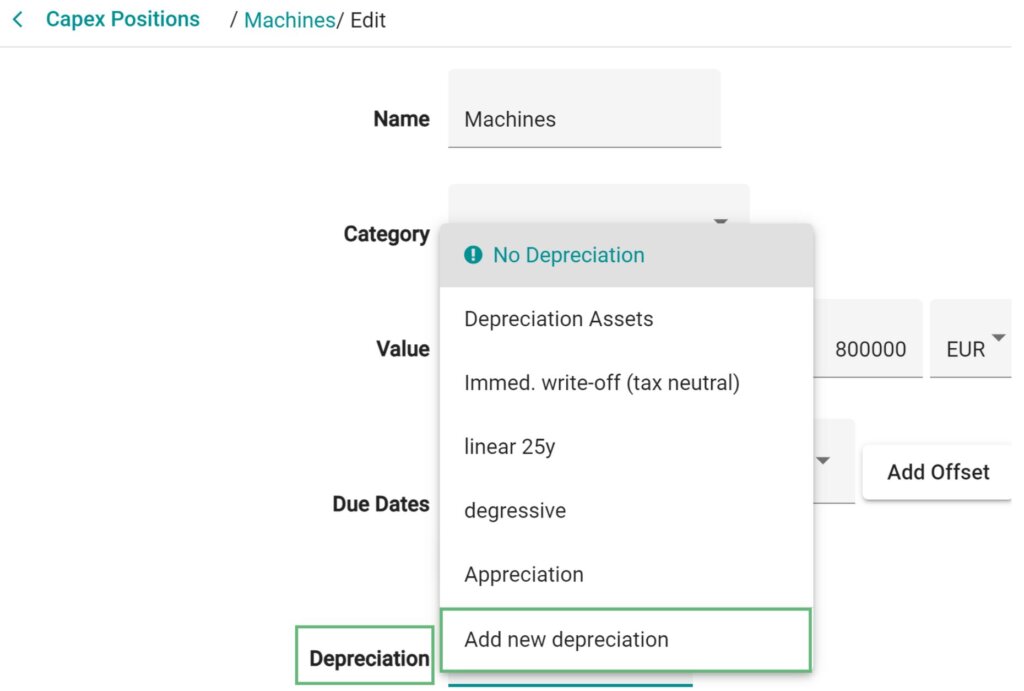

If you like to add a depreciation to an already existing Capex item, select the relevant item in the “Capex” section and click on the depreciation dropdown.

- Choose “Add new depreciation” to create a depreciation method.

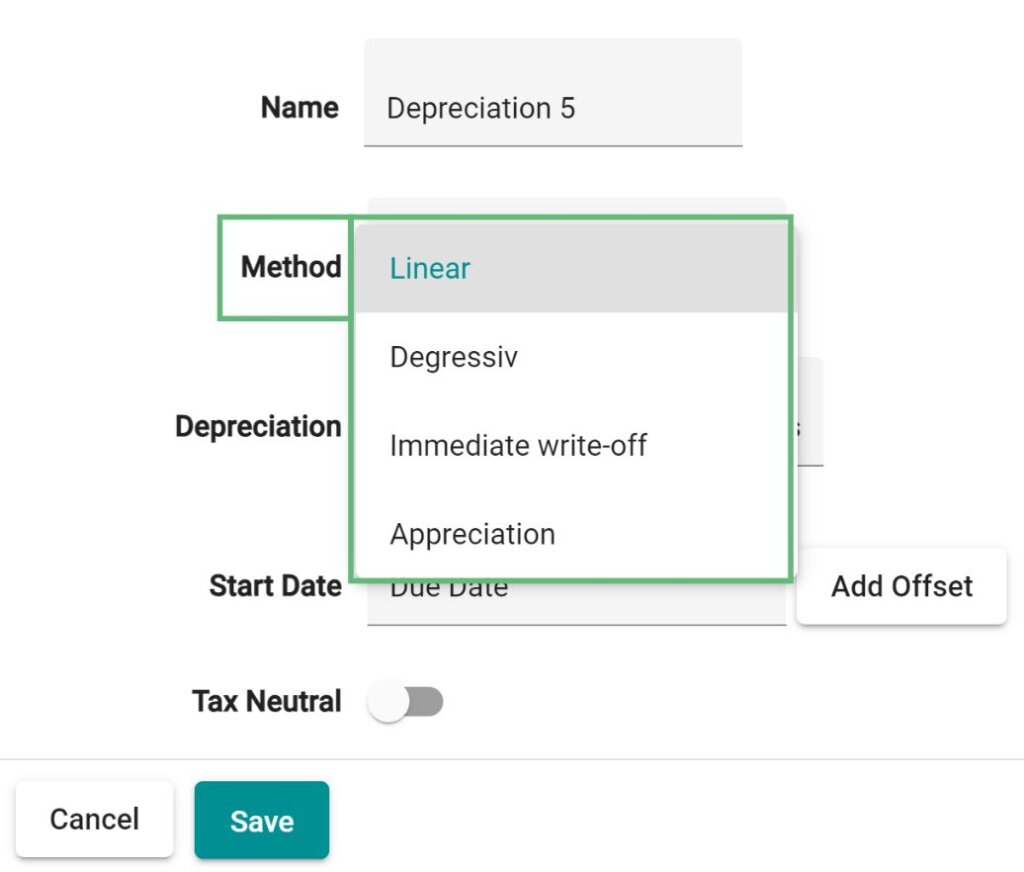

- You can choose between four different depreciation methods:

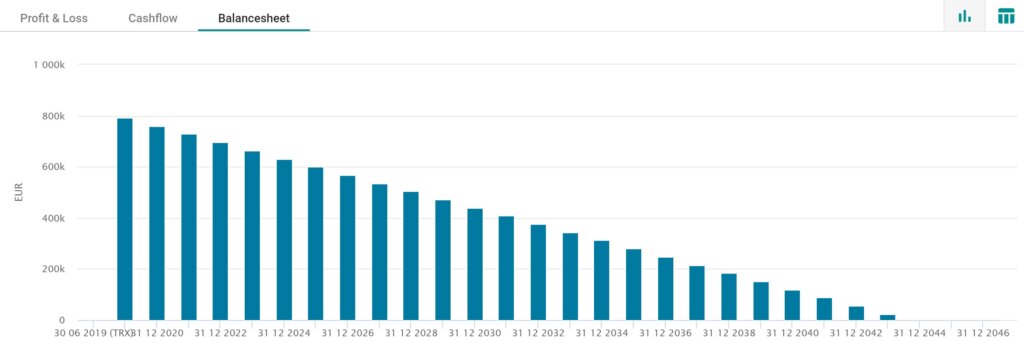

- You can see the different depreciation methods in the profit & loss statement.

- Linear:

- In case of a linear depreciation, you have the same amount of annual depreciation over the operating life.

Example: Linear depreciation over 25 years with an investment in a component supply in the amount of 800,000 EUR.

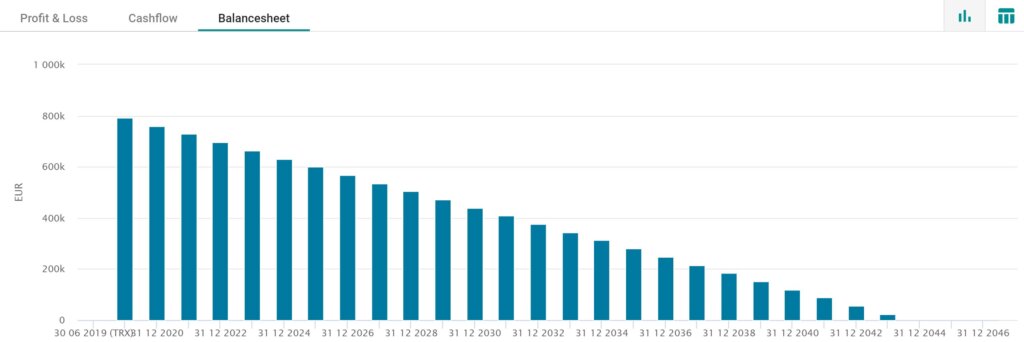

- Degressiv:

- With a degressiv depreciation the amount is decreasing over the depreciation period. This means that the first years are more heavily charged.

Example: Investment in a component supply in the amount of 800,000 EUR, depreciation rate 20%, Residual write-off 15 years.

- Immediate write-off:

- The entire amount is amortized at once.

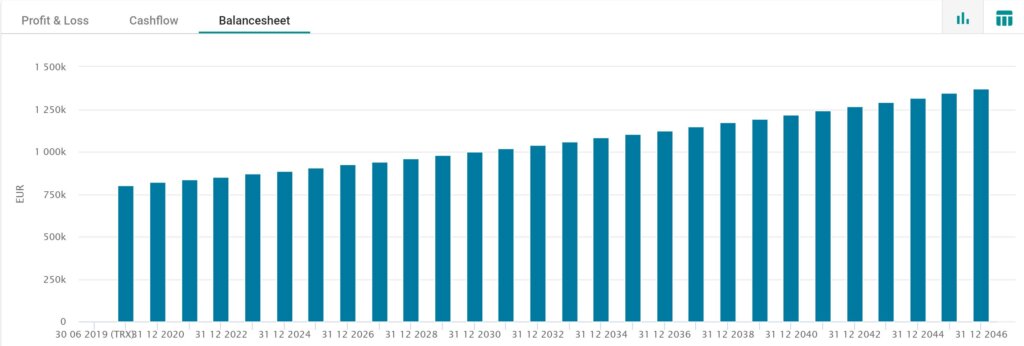

- Appreciation

- In case of a appreciation the entire amount is increasing over the years.

Example: Appreciation of 2% on the acquisition value of 800,000 EUR.

- By clicking on “Create” the depreciation is saved. The depreciation method is automatically assigned to the desired Capex.