In this article you will learn what the Residual is and how it is calculated.

You will find the area “Residual” in the “Capex” section. This area is only visible if you have already added investment cost positions.

The residual is calculated as follows:

Residual = Asset purchase price – Capex (included in asset purchase price)

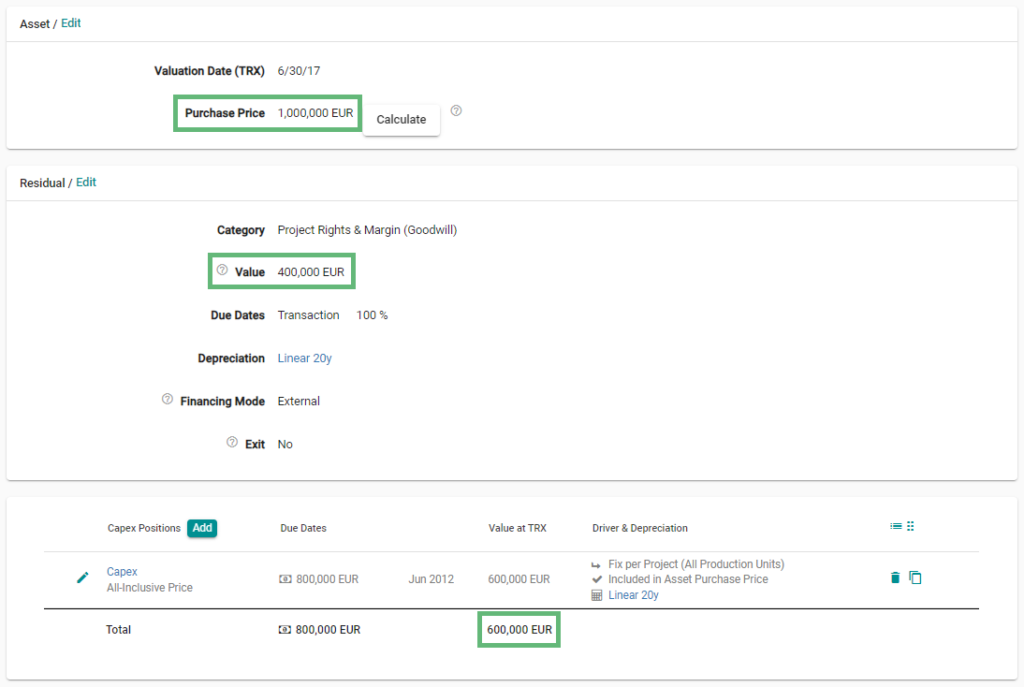

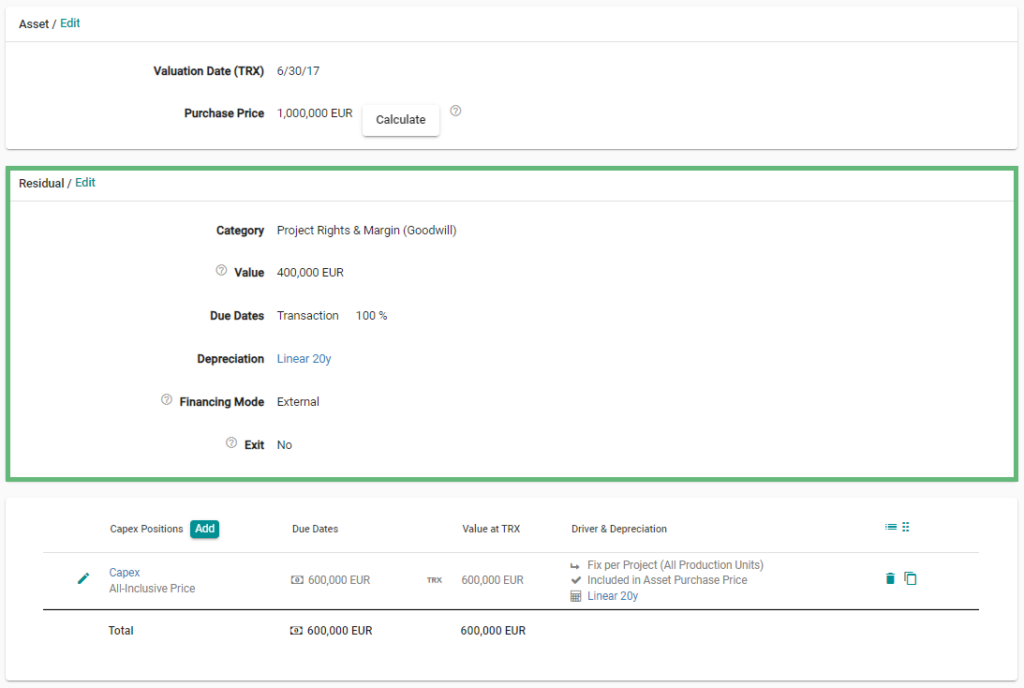

In our example we have a purchase price of 1,000,000 EUR and a Capex position of 600,000 EUR. The residual amount is therefore 400,000 EUR.

Note: If besides the purchase price, all detailed construction costs are known and captured as Capex items, the residual therefore corresponds to the project margin of the seller.

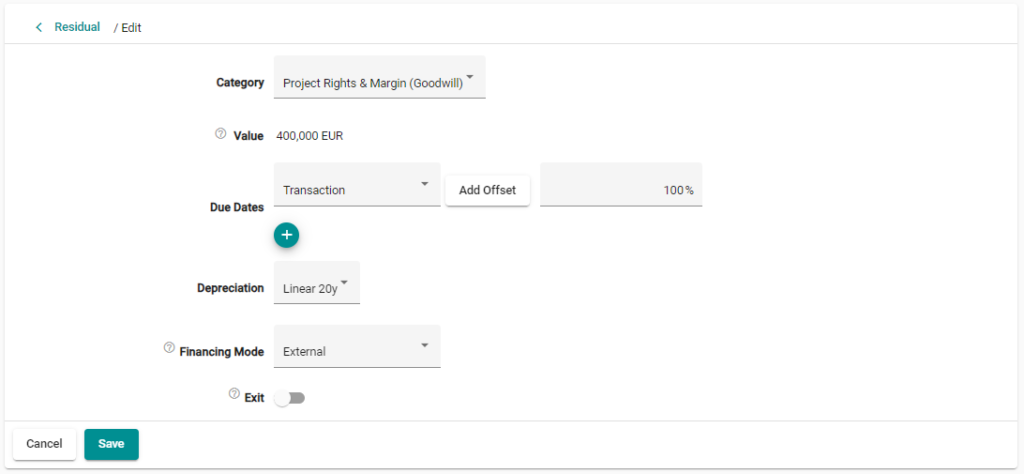

If you select the area “Residual”, you have the possibility to fill in the following input fields:

- The category

- The due dates (How to specify different Capex due dates?)

- The depreciation: Please note: The input field “depreciation” only counts for the residual and not for the different Capex item. If you would like to add a depreciation to the respective Capex you can find additional informations here.

- The financing mode (What is the difference between external and internal financing?)

- The Exit mode (How does a Capex Exit work?)

Read the corresponding article to learn more about the specific topic.

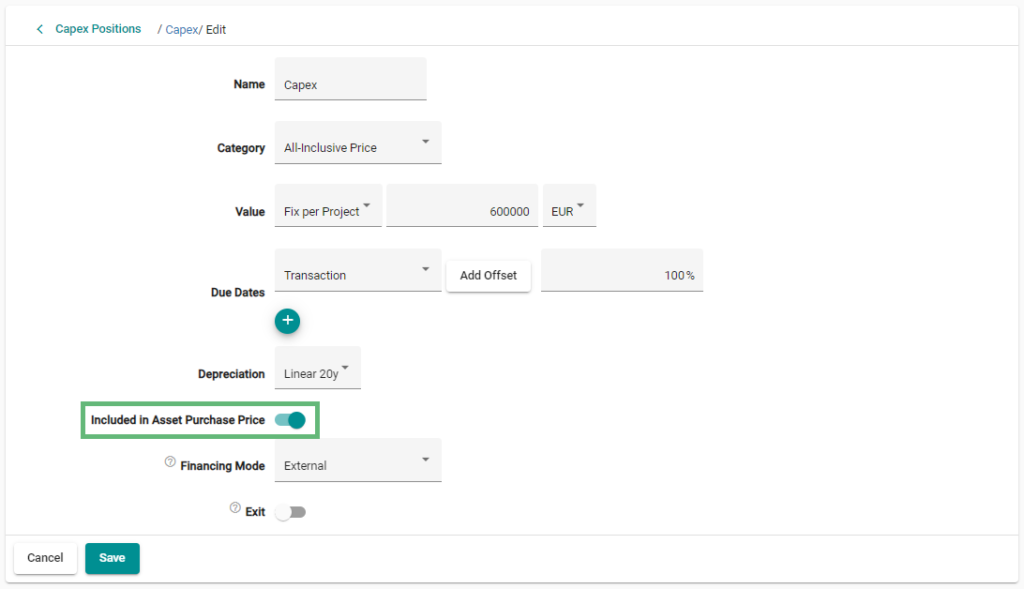

The residual is reduced by all investments included in the asset purchase price. If you want to model capex positions, wich are not included in the purchase price, you can deactivate the input field “Included in purchase price”. You will find more about this topic in the article “What does included in the asset purchase price mean?”.

Please note: If the due date of a Capex item is earlier than the transaction date, and if it has already been partially written off, the book value at transaction is taken into account (not the acquisition value).

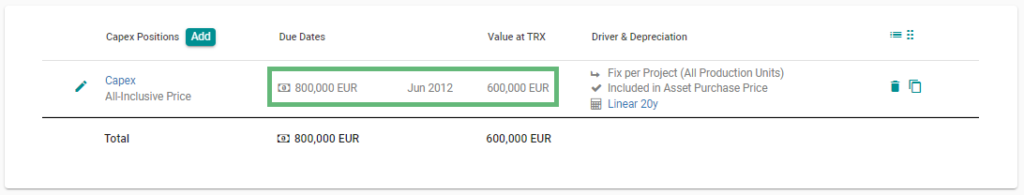

Example:

We have acquisition costs of 800,000 EUR. The due date is 06/2012 and therefore 5 years before the transaction date 06/2017. The Capex have been written off linear over 20 years. This leads to a book value (value at transaction) of 600,000 EUR on 06/2017.

An asset purchase price of 1,000,000 EUR will therefore lead to a residual of 400,000 EUR (1,000,000 EUR – 600,000 EUR).