about us

Vision

We are convinced that the energy transition can only succeed if investments in renewables are managed professionally and sustainably. The sustainable success of this asset class is enormously important and has been what motivates us all every day since greenmatch AG was founded. Click here for our mission film:

About us

Before founding greenmatch, our founding team invested in renewable energy projects across Europe for funds and municipal utilities. Back then, they developed the idea of a standardised, efficient and reliable solution that supports the investment process over the entire project life cycle and different technologies.

Following the trend towards web-based software, greenmatch was founded as a fintech in Basel in 2013. In 2015, we launched our transactional financial model, followed by a digital marketplace in 2016. In response to our clients’ needs, we developed a financial asset management solution and launched it in 2019.

Investments in renewable energies have been growing steadily for many years. However, they continue to underutilise the existing, very large, potential, which is due, among other things, to inefficient financial evaluation and controlling methods.

We are only at the beginning of a continuous professionalisation of the entire renewable energy industry. Investments in this asset class need to be managed by professionals in a value-adding and transparent manner.

With greenmatch, we are proud to have set the standard for the financial evaluation of renewable energy investments trusted by investment managers, banks and project developers. We combine our unique software with proven expertise in renewable energy finance. In close cooperation with our customers, our in-house development team is continuously working on new features to adapt our software to changing market requirements.

We currently serve >25 corporate clients. Large investors in renewable energies trust and rely on greenmatch to ensure the continued growth of their portfolios. Already today, more than 1.3 gigawatts are managed by greenmatch. Are you also ready to make the next step?

Unique Selling Propositions (USPs)

Standardised software which is continuously adapted to customer needs

Lifetime end-to-end financial overview and effective financial monitoring of existing assets by matching performance with plan and defined performance indicators

A long-term strong relationship with top tier customers

Added-value by reducing operational risk and enabling improved profitability

Complex project structures can be modelled, simulated and presented in a simple way within a short time

Agile system that can be scaled and adapted to other asset classes

Core Competencies

Improve efficiency of existing resources

Data recording and processing in top quality and at highest standards regarding security and output

The software service tools support both operational teams and strategic decision-makers

The application of greenmatch leads to quick improvement of portfolio quality and performance

Enabling a standardised and highly efficient assessment of projects

TEAM

In our team, multinational specialists from different disciplines work closely together to further develop greenmatch and our products.

SaaS & Data Security

Software-as-a-Service model (SaaS)

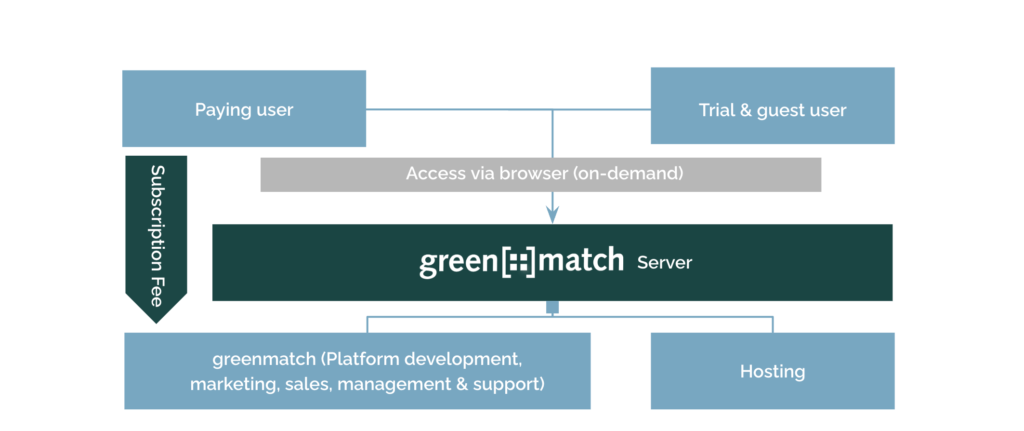

The greenmatch business model follows a stringent B2B Software-as-a-Service strategy and fulfills the modern requirements of ambitious B2B customers.

The software is hosted on highly secured servers outside of the customers IT environment. Continuous deployment enables ongoing updates without any interruptions or technical interventions of the customers IT infrastructure.

Customers can access the software easily and from any location, the only thing they need is a web browser and an internet connection. Projects can be shared with external partners easily.

Data Security

We place the highest value on the security and protection of your data.

All our servers are located exclusively in highly secure data centres in Switzerland. The data centres are ISO 27001 certified and meet the strict requirements of FINMA-RS 08/07 (Outsourcing Banking).

Our internal processes are certified according to ISAE 3402. As an IT service provider, we thus meet the highest requirements within the framework of outsourcing management (outsourcing of IT services). With this set-up, we fulfil the most demanding of all conceivable regulatory customer requirements: Those of banks.

CONTACT

We look forward to hearing from you:

YOU WOULD LIKE TO STAY UP TO DATE?

Subscribe to our newsletter and receive regular information on topics such as renewable energies, project financing, digitalisation, investment, asset & portfolio management!