How can the energy transition succeed in the shortest possible time? In addition to the adaptation of the legal framework, the current discussions are losing sight of what forms the basis for the continuous success of the renewable asset class: economic viability and financial profitability. In a rapidly changing environment such as that of renewables, it is crucial not to lose sight of the real profitability of projects. Especially with high competitive pressure and correspondingly high prices for seemingly attractive investments, it is essential to keep an eye on the actual financial performance of the operating power plants. But what information is the most reliable and meaningful basis for this? In this article we explain how you can keep an overview and lay the foundation for an increase in financial performance.

Updated financial plan as basis for analysis

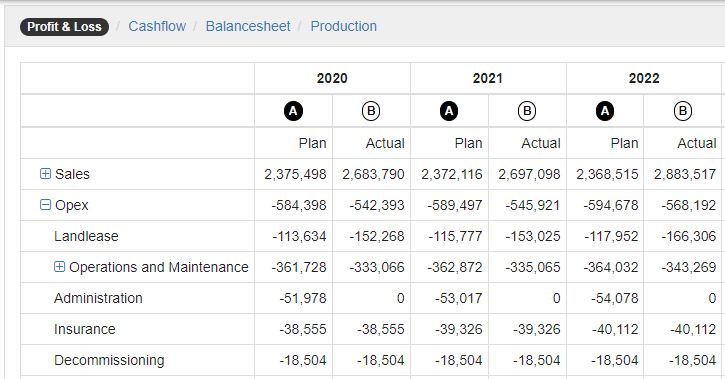

It is best to focus your analyses on the deviations between planned and actual performance. For this purpose, the initially modeled transaction plan should be enriched with current figures from financial accounting in order to obtain a so-called updated financial plan. The comparison of the transaction plan and the updated financial plan allows you to analyse in which categories deviations between the planned and actual status have occurred, provided that both plans retain the same basic structure and calculation logic.

Analyse deviations

It is particularly important to ensure that all cost items are grouped into suitable categories when drawing up the transaction plan. This offers the possibility to proceed systematically in the analysis and to narrow down and identify the biggest weaknesses of the project as quickly as possible:

For example, operating costs that have gotten out of hand can be broken down precisely and proposals for adjustments can be developed.

Define and implement corrective measures

Higher maintenance costs can quickly lead to a potential liquidity gap, which should be anticipated and corrected in time to prevent the insolvency of the affected project company. Depending on the origin of the deviation between target and actual, corrective measures can include renegotiating specific contracts or adjusting the financing structure. If possible, various options should be examined and their impact on the overall return of the project compared. If problems are identified in time, the asset manager usually has sufficient lead time to examine and implement appropriate measures.

Measuring success

It is particularly important to continuously track the impact of the adjustment of relevant contracts and financing parameters on real performance. We therefore recommend quarterly, but ideally monthly, supplementing the actualised financial plans with the current accounting data, analysing the data and thus actively managing your renewable assets financially. Form as early as possible the basis for efficient financial performance monitoring of your projects and use the digital possibilities of a standardised financial model such as greenmatch!