Debt sculpting is a commonly used tool in project finance, more precisely in the structuring of debt within a project. It can be used to maximise the debt in a project and increase the leverage effect.

The method of debt sculpting permits to adjust the repayment schedule of debt to the cash flow generated by the concerned project, resulting in variations of the debt service amount throughout the project lifecycle.

This variation in debt repayment follows the variation of the cash flow available for debt service. In other words, when the cash flows are low, debt service payments will be low too and of course, in case of high cash flows, the debt service will also increase.

The sculpting is usually calculated based on the DSCR (Debt Service Coverage Ratio), required by the lender. The DSCR is calculated as follows:

Instead of having different DSCR’s at different points in time, debt sculpting will make sure to have a stable DSCR throughout the entire project lifetime.

Within greenmatch, you can easily create a sculpted redemption profile as follows:

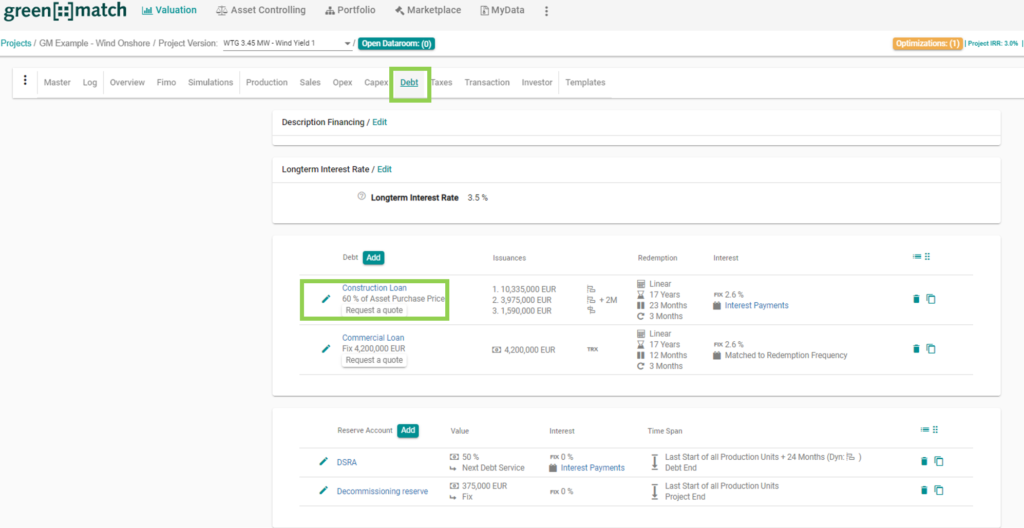

- Go to the Debt Section of your project and click on the loan for which you would like to create a sculpted redemption profile:

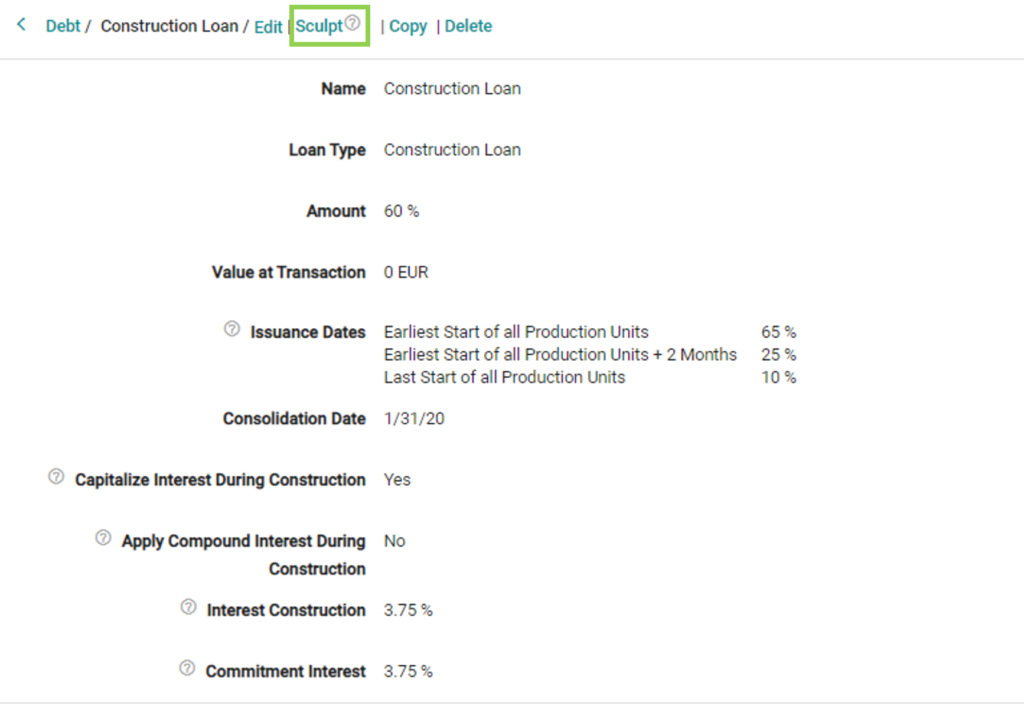

- Click on “Sculpt”:

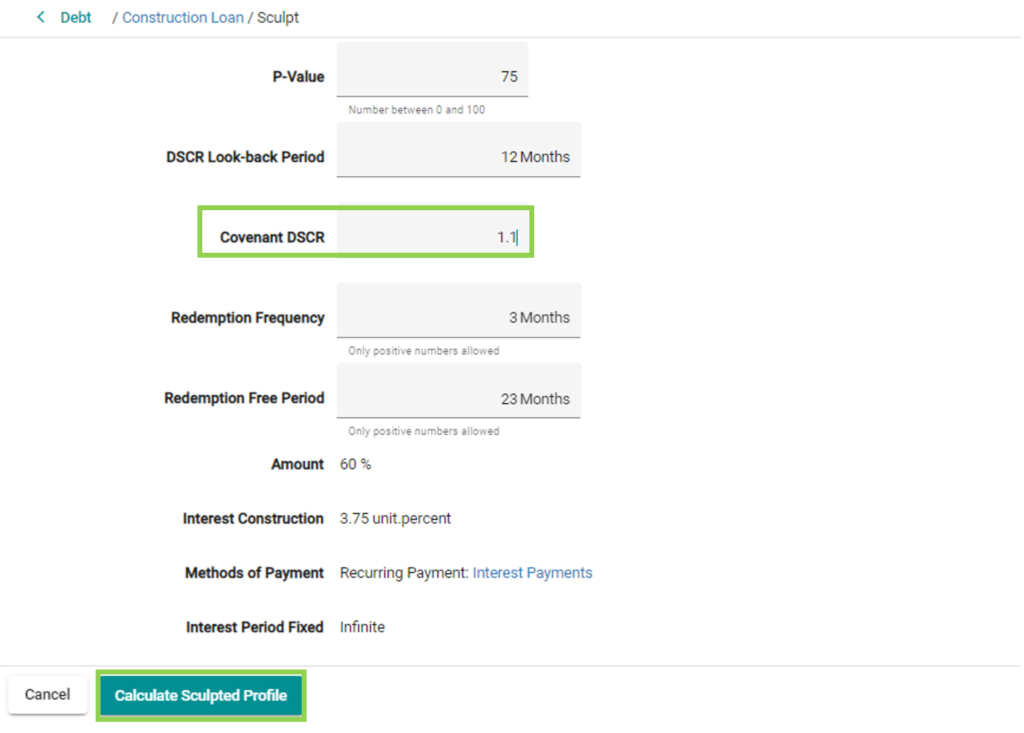

- Enter the Covenant DSCR and other applying parameters and confirm by clicking on “Calculate Sculpting Profile”:

Using this functionality will allow you to always redempt as much debt as possible, depending on the cash flow generated by your project. You are interested in modeling your renewable energy project in a standardised and efficient way? Then register now for your personal trial account: