Cash sweeps are an important aspect of Project Financing and often required as part of a borrower’s loan agreement with a lender. By reducing the outstanding loan balance, the cash sweep payments act as a buffer against other years where the borrower may incur lower revenues as a result of revenue volatility.

By agreeing to a cash sweep with the lender, a borrower can often extend the length of the loan, and some lenders may agree to increase the total amount of the loan due to such provisions. Furthermore, by repaying outstanding debt earlier via a cash sweep the remaining interest payments on debts are effectively reduced.

How does a cash sweep work in practice?

A company exercises a cash sweep by using excess cash to pay outstanding debts ahead of the scheduled payment date instead of distributing it to its investors or shareholders.

The amount of cash that is “swept” using this feature is the balance that remains after all other financial obligations have been satisfied. For a renewables project, this means the amount of money that is left after all regular debt payments and operational expenses have been taken care of.

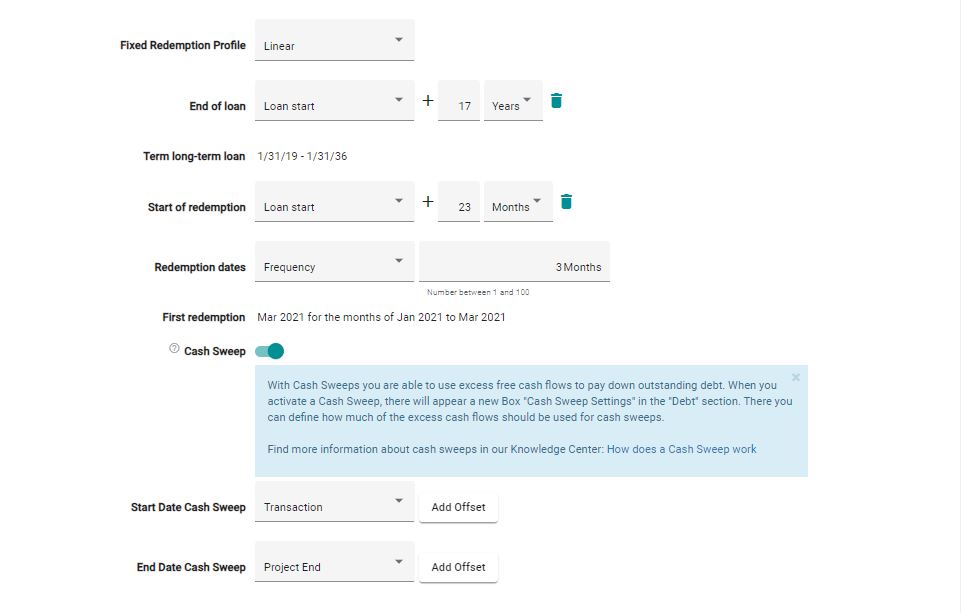

Modelling cash sweeps with greenmatch

With greenmatch you can easily model a cash sweep by activating it in the debt functionalities, instead of manually having to model it via Excel:

Furthermore, margins of error are reduced, since greenmatch offers a standardised fully integrated financial model that is regularly reviewed by EY. You are interested in modeling your renewable energy project in a standardised and efficient way? Then register now for your personal trial account: