International portfolios, complex projects, a wide range of tasks and competition with the conventional energy market – to name only a few of the challenges in the asset management of renewable energies. How do you nevertheless maintain an overview and achieve the defined goals?

From our experience, all you need is the right approach. Use these five tips for efficient financial asset management:

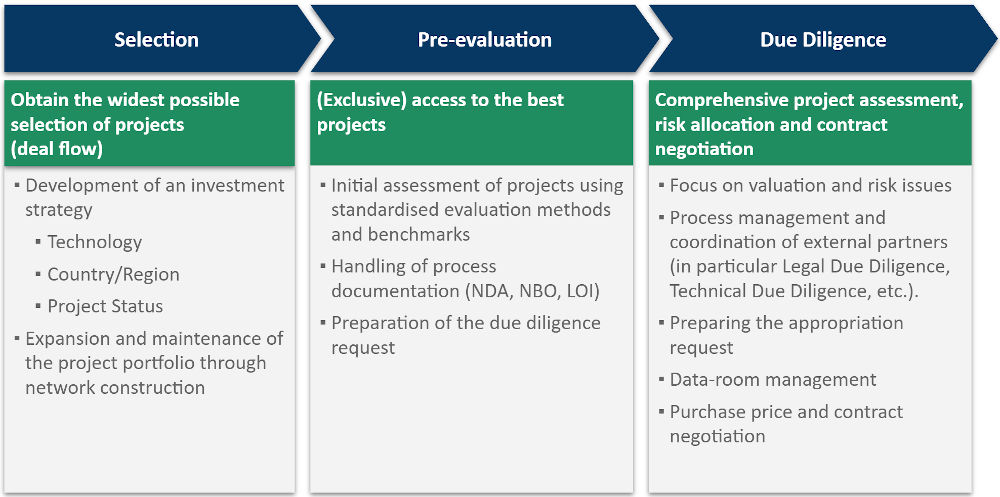

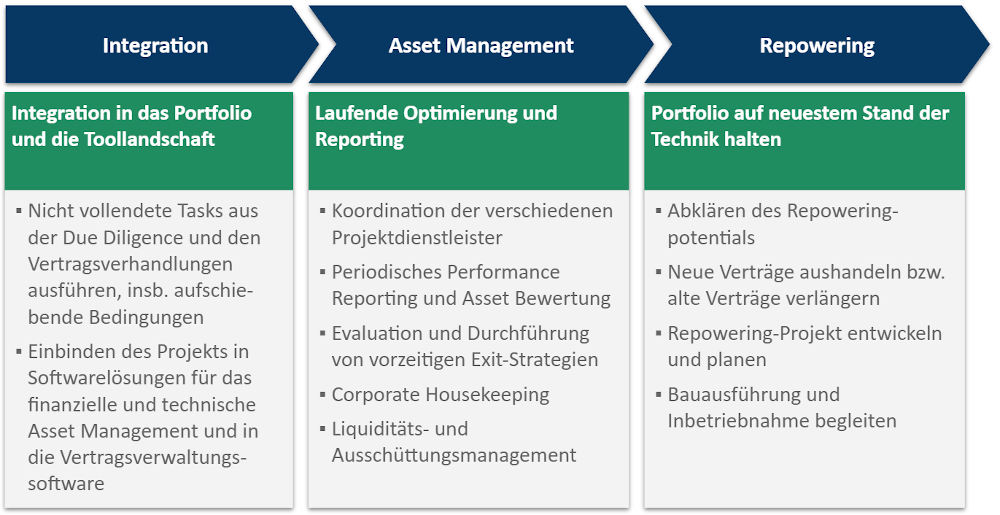

Tip 1: Consider the entire investment process

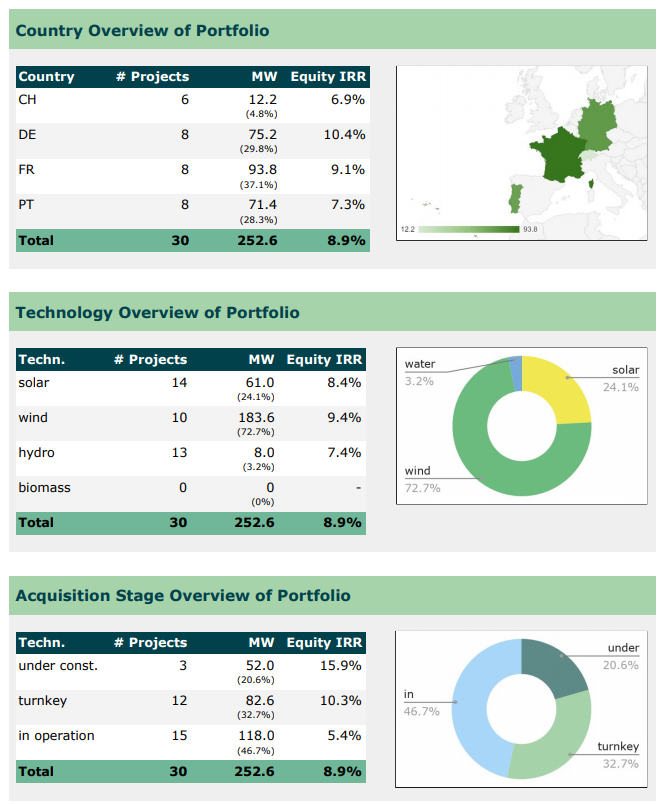

In asset management, always and constantly keep the complete investment process in mind; from pre-evaluation to repowering. Financial asset management can provide you with valuable information, for example for the acquisition of future projects. Use the data that is on hand and gain new insights, for example: Is the return on solar projects in Spain as high as assumed? Or: Do any changes need to be made to the investment criteria? Learn from your data.

Tip 2: Set uniform standards

Would you like to integrate a new project into your portfolio? We have the following three recommendations for integration:

- Standardise the chart of accounts. Together with the commercial manager, you adjust the chart of accounts of a specific project to your company’s standard. Standardisation makes it easier to manage and monitor your projects.

- In order to keep any coordination effort as low as possible, we recommend that you work with only one partner (e.g. per country or per pillar in asset management) instead of commissioning different companies. This makes standardisation easier to implement and you avoid having to deal with data of different formats.

- For the financial model, too, use a standardised framework. The categorisation of operating items according to a company-wide standard, for example, is helpful for the later target-performance comparison.

The magic word is “standardisation”. The faster and easier you can get an overview of your assets, the more efficient you will be.

Tip 3: Increase the transparency of your investments in renewable energies

If you can’t measure it, you can’t improve it!

In line with this guiding principle, it is essential for investors to monitor the financial performance of their renewable energy projects: Actual figures are continuously recorded and compared with the original transaction assumptions. At the same time, planning assumptions such as electricity price forecasts or interest rate expectations must be kept up to date.

Prepare the data as accurately as possible – this makes it easier to create convincing reporting. Use the insights you gain to create more transparency and to always keep an eye on the actual value of your assets.

Tip 4: Assign a new level of automation to asset management

There are two options for automating the management of energy facilities:

- Automate error management. An example of how to do this: If errors occur in your calculations, an error message is displayed and you are automatically informed on how to correct the error.

- Automate data entry. Using the example of the error described above, this would mean that intelligent solutions can automatically correct previously identified errors, so you do not have to correct the error yourself.

The choice of the best suitable option is an individual issue. There are various solutions on the market for financial and technical asset management and for the automation of many different tasks. What they all have in common is that they can transfer information from other tools (such as accounting software) using interfaces. This saves time and effort, as data does not have to be entered manually. At the end this allows more time for the analysis and optimisation of assets.

Tip 5: Let your data grow in a structured and consistent way

Data tend to become increasingly unstructured over time, no matter how systematically you start. Perhaps you are familiar with the following: You have important spreadsheets and files on various computers, SharePoints or network drives; all these files need to be managed. In addition, the structure of the files naturally differs over time and you can only ensure consistency with a great deal of effort.

In financial asset management, it is therefore essential to have the relevant figures available at one central location and to define this location as the Single Point of Truth (SPOT). This provides you with a reliable source of data with a consistent structure at all times – regardless of how much information you manage or with whom you share it.

Five tips = five opportunities. With these five suggestions you can increase efficiency in the asset management of renewables. Give it a try!

Our experts are available to provide you with more tips. Ask about our solutions for asset management: