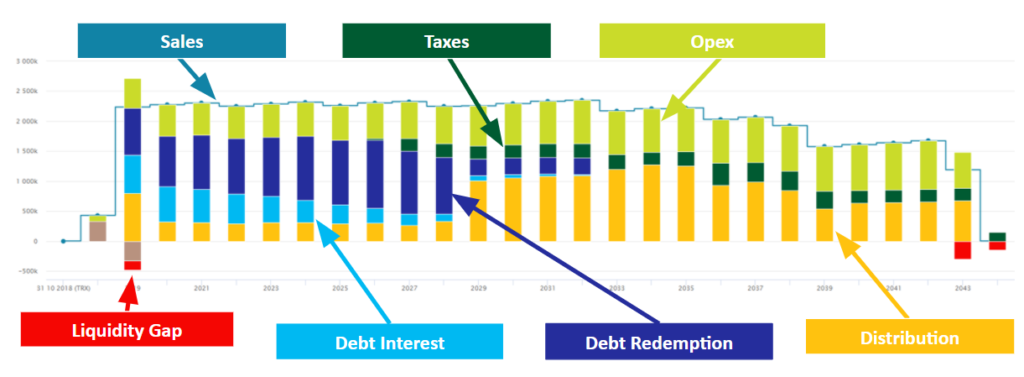

The cash flow waterfall is mainly used in financial modelling to get as quickly as possible a precise overview of the financial structure of a project.

The greenmatch cash flow waterfall gives you a complete overview of all project-specific cash flows and the intended use of all received amounts. Thus, for example, potential liquidity gaps or excessive leverage can be identified at a glance. It is therefore an important tool for the proper planning and structuring of a project over its entire lifecycle. But how is the greenmatch cash flow waterfall actually structured?

Structure of the greenmatch cash flow waterfall

In addition to the revenues generated by a project (cash-in, represented by a green line), all cost items (bars) are shown over the entire project lifecycle. This essentially includes all operating costs (opex = light green), debt service (debt repayment and interest = blue), taxes (dark green), formation and dissolution of reserves (brown) and capital flows to the equity provider (yellow).

Liquidity planning as the basis for distribution management

As already mentioned, possible liquidity gaps can be easily identified by means of the cash flow waterfall. If a project is not structured in a sustainable way (e.g. through too short bank maturities or too high leverage), more cash-outs may be foreseen than the project can generate on its own at a specific time. These liquidity gaps should be remedied in good time through discussions with the financing bank or through other financing options. In addition, the cash flow waterfall can be used to identify the ideal times for distributions, i.e. dividend payments, and thus plan the payouts to shareholders.

Keep track of your investments in renewables with the greenmatch cash flow waterflow: Request your trial account now!