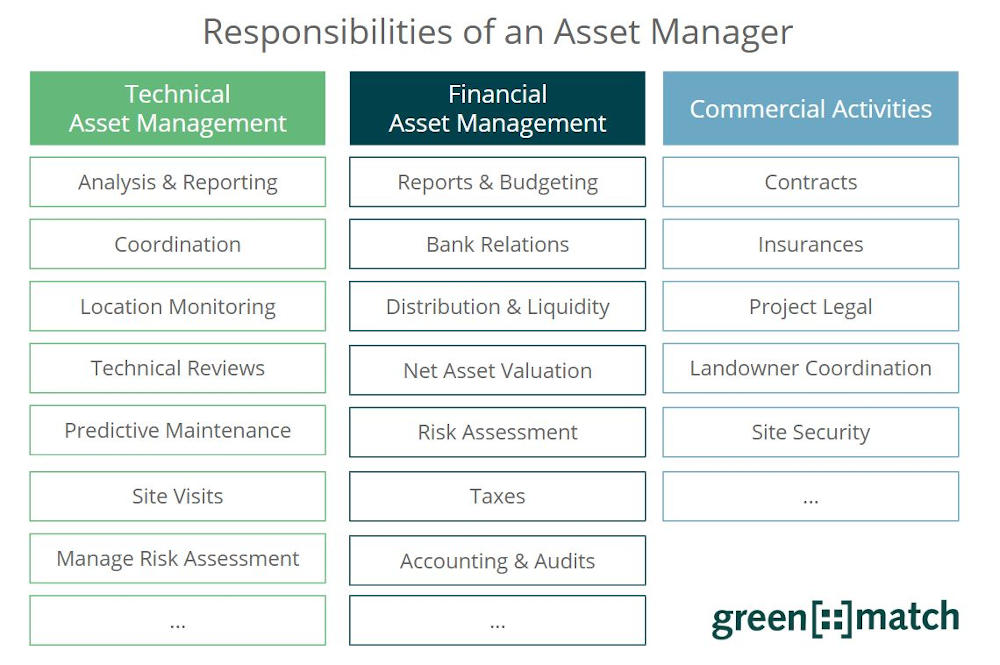

The 3 Pillars of Asset Management

The asset management of renewable energies is based on three pillars. They are closely interconnected and form the tasks of an asset manager:

- Commercial Pillar

- Technical Asset Management

- Financial Asset Management

On the basis of these three pillars, we would like to illustrate the main tasks in the asset management of wind farms, solar plants, hydropower plants & co.

Responsibilities of an Asset Manager for Renewables

1. Commercial Activities in Asset Management

Contract and insurance management, cooperation with landowners, maintaining security at the site and all other project legal activities are referred to as the commercial pillar. In particular, the negotiation, administration, implementation and handling of the wide range of contracts and insurance policies requires the asset manager to work in the most structured and efficient way possible. Due to the fact that renewable energies are becoming increasingly complex and professional, the asset manager of today is confronted with various challenges.

2. Technical Asset Management

Technical asset management involves primarily the analysis and reporting of energy production as well as any losses. The asset manager should always bear in mind the risk of potential losses (risk assessment). Unfortunately, other tasks such as the coordination of technical operators, maintenance companies and grid operators, as well as technical reviews, certifications and site visits take up a lot of time. As a result, however, optimisation potential in production is often missed, through which additional revenues would have been possible. Technical asset management also includes real-time site monitoring and predictive maintenance.

3. Financial Asset Management

In financial asset management, the focus lies on the preparation of management reports and budgeting. Preparing the necessary data is extremely time-consuming. In practice, this usually means that the analysis and optimisation of the respective assets is often neglected: Mainly due to the huge amount of information that needs to be collected, processed and analysed.

Financial asset management also includes the coordination of accounting and audits, liquidity and distribution management, responsibility for bank relations and corporate housekeeping. In addition, tax, net asset valuation and ongoing risk assessment should not be neglected.

The secret of financial asset management is to keep a constant eye on the most important key figures and to keep returns under control. This is a complex task given the large amount of different data. Complex data streams should be provided in the simplest possible format the right place at the right time. The digitalisation of asset management helps to save a considerable amount of time: Today, automated imports, standardised evaluations and archiving, alerts as well as performance and error analysis can now be used with digital asset management solutions. They help increase the efficiency and effectiveness of asset management.

Mastering the Asset Management Tasks

The graphic shows the variety of tasks an asset manager has to deal with. The comprehensive presentation of key information can be of valuable support for the asset manager with regards to sensitive issues of his assets in renewable energies. This in turn has a positive effect on the profitability of the assets under management.

To find out which major and minor challenges you can meet in asset management, read our blog post about “Challenges of an Asset Manager“.

Would you like to keep up to date with the latest developments in renewable energies, financial modelling and digitisation? Subscribe to our newsletter and receive professional articles, industry insights and interesting news about greenmatch!