In this article you will learn how you can capitalize interests during construction. This means, that no interest payments will take place during the construction phase.

- First create a debt object. To do this, go to GM Valuation’s « Debt » section and click « Add » in the « Debt » area.

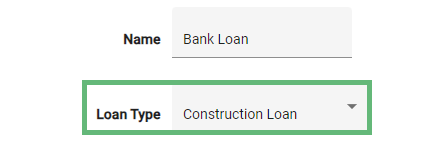

- Choose « Construction Loan » as Loan Type.

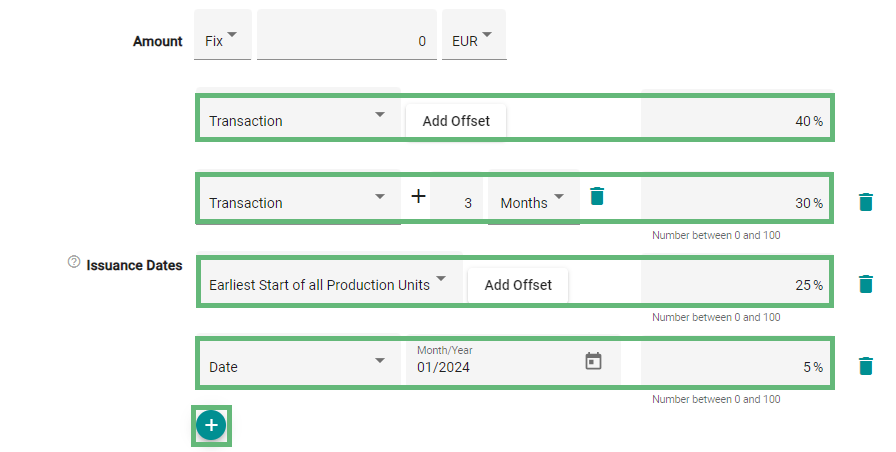

- With the input value you can determine the amount of the construction loan. With the input « Issuance Dates » you can enter several issuances for the credit type « Construction loan ». By clicking on the « + » button you can add several dates. A date can be entered in reference to the transaction or commissioning (see relative data) or as an absolute date. For all dates except the first, you define the percentage that will be paid out of the total loan amount (see Value). The first date is always calculated as a residual value so that the sum of all individual dates is always 100%.

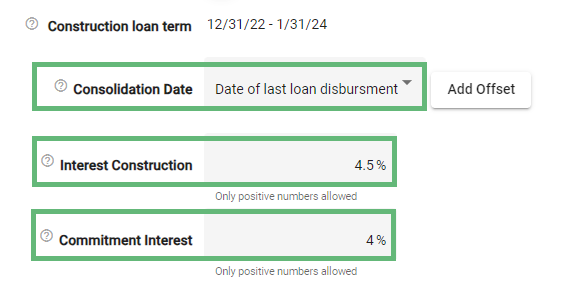

- The last date recorded is by default the consolidation date. However, you can also change this date using the input field « Consolidation Date ». At this point the entire loan is disbursed. The building loan is thus converted into a long-term loan. Between the first disbursement date and the consolidation date, the interest rate for the construction loan and the entry for the « Commitment Interest » apply. The interest on the construction loan is applied to the amount already disbursed and the commitment fee to the amount not yet disbursed.

Get more information in our Knowledge Center article: How to work with relative date relations

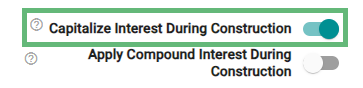

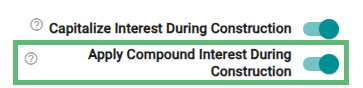

- Activate the option « Capitalize interest during Construction ». If this option is activated, accrued interest & commitment fees during the construction phase (between the first issuance date and consolidation date) are capitalized and added into the nominal loan amount at the consolidation date. The final loan amount consisting of the nominal loan amount plus the capitalized interests & commitment fees will be amortized according to the defined repayment method. Consequently there are no interest payments during the construction phase.

Attention: This option is only available for the credit type « Construction loan ».

- When the option « Apply Compound Interest During Construction » is activated, there will be compound interest applied on accrued interest during the construction phase (between the first and last issuance date).

- Enter the remaining inputs of the debt object. This includes entries for repayment and interest. Then click on « Save » to confirm the entries.