Cet article n’est disponible qu’en allemand et anglais

In this article we will explain how you can calculate two of the most important KPI’s in Project Finance: the NPV & IRR.

Net Present Value (NPV)

The Net Present Value (NPV) is one of the most important key figures for evaluating the value of a project. It results from the sum of the future cash flows of an investment discounted to the valuation date (t0).

In order to calculate the Net Present Value of a project, you need the following information:

- Cashflow to Equity (cash inflow and cash outflow) for all different periods of the project lifetime (t0, t1, t2, etc.)

- Discount rate of the concerned project

- Project lifetime

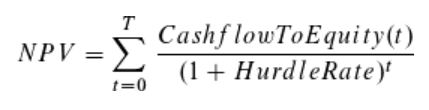

With this information, we can calculate the present value for each period. Therefore we need to use the following formula:

The following table serves as a simple calculation example:

As we can see, the received amounts (Cashflow to Equity) are the same (3.200 EUR) in the years 2021 and 2024 but the present value is higher for 2021. This is due to the fact that the same amount has always more value the earlier it is received (positive interest rates assumed). To learn more about this mechanism, you can read our article about the Discounted Cashflow Model.

By summing up all present values of the concerned project you will get the so-called NPV:

A NPV must be higher than 0 in order to be profitable. It expresses the profitability of the project in an absolut number. Below we will describe the concept of the internal rate of return (IRR). This KPI determines the discount rate that reduces the NPV of an investment to zero.

Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is another KPI permitting to evaluate the profitability of a project. It is expressed in % and indicates the annual rate of return of the project. Since it is a relative number, it can be used for the comparison of projects of different technologies and investment volumes and also for the comparison of alternative investments opportunities in the securities market. Therefore it is used by the majority of all investment professionals.

In order to calculate the Internal Rate of Return, you need the following information:

- Free Cashflow (in order to calculate the Project IRR)

- Cashflow to Equity (in order to calculate the Equity IRR)

- Project lifetime

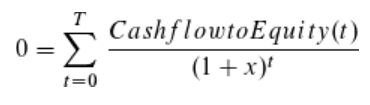

For the calculation of the IRR you use the same formula as for the NPV, but you are setting the NPV to 0 and determine the discount rate. As there are different IRR’s to address different issues, the cash-in and cash-out used differ. The Project IRR is using the Free Cashflow (also named Cash Flow Available For Debt Service), whereas the Equity IRR uses the cash flow to equity. For the calculation of the Project IRR you use the following formula:

For the calculation of the Equity IRR you use the same formula but replace the Free Cashflow by the Cashflow to Equity:

The IRR rule states that the project can be pursued if the IRR for a project is higher than the required minimum return, usually the cost of capital. Important to understand is that the concept of IRR assumes reinvestment of free cash flows at the internal rate of return. Therefore, the IRR overstates the annual equivalent return for a project that has internal cash flows that are reinvested at a lower rate than the calculated IRR. Note: To learn more about the different types of IRR, please go to our article “What is the difference between Project IRR, Equity IRR and Payout IRR?”

Will be explained in the video as well