If you don’t want to fall below a predefined DSCR in your financial plan, you can use the debt sculpting solver and greenmatch will calculate an individual redemption profile for your debt financing based on the defined DSCR.

How can you use the Debt Sculpting Solver?

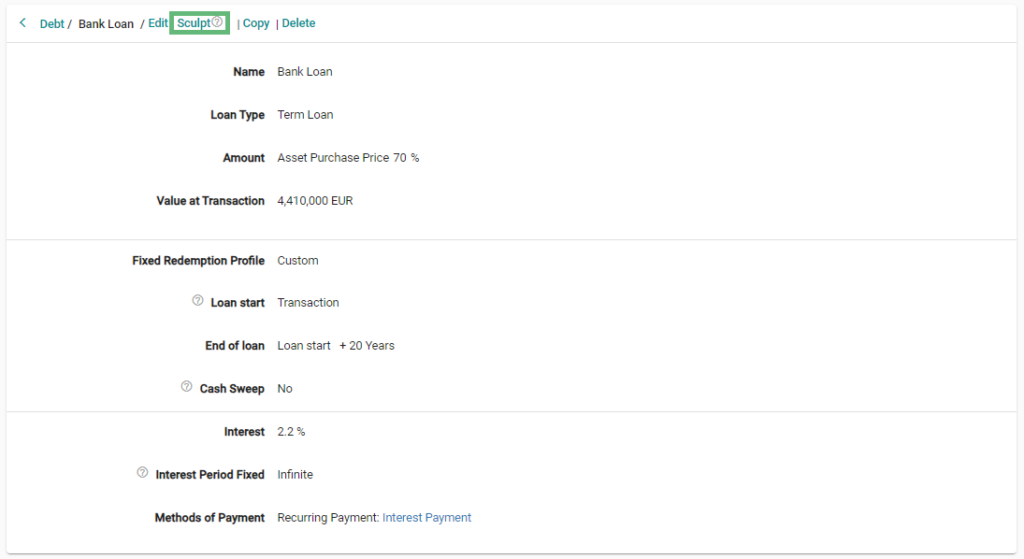

- Create a debt object in the “Debt” section by clicking on “Add”.

- Enter the parameters like Name, Amount, Issuance Date, Loan Period and Interest. You can leave the Fixed Redemption Profile input as “Linear”.

- Save the debt object by clicking on “Create”

- You are now in the detail view of the Debt object.

- Click on “Sculpt” in the object edit bar.

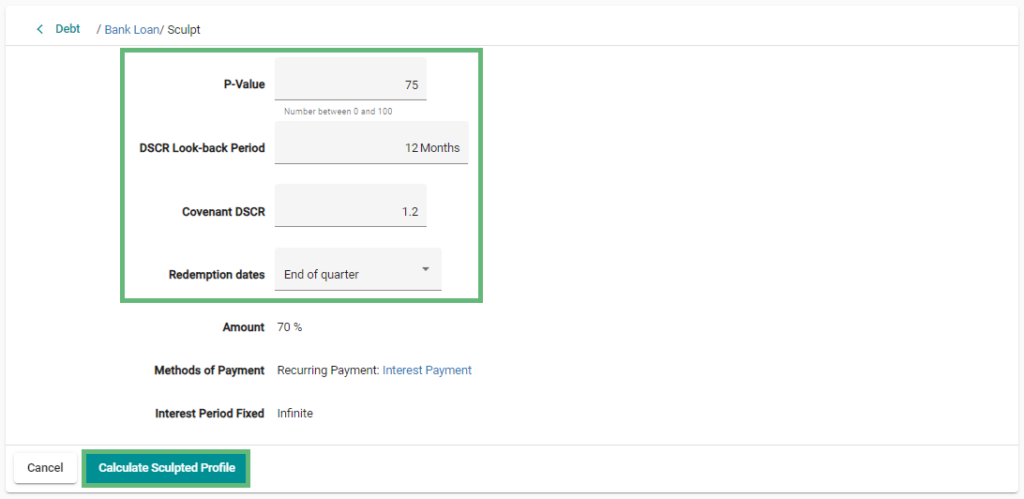

- Input the P-Value, the DSCR Look-back Period, the Covenant DSCR, the Redemption Frequency and the Redemption Free Period.

- Confirm the inputs by clicking on “Calculate Sculpted Profile”.

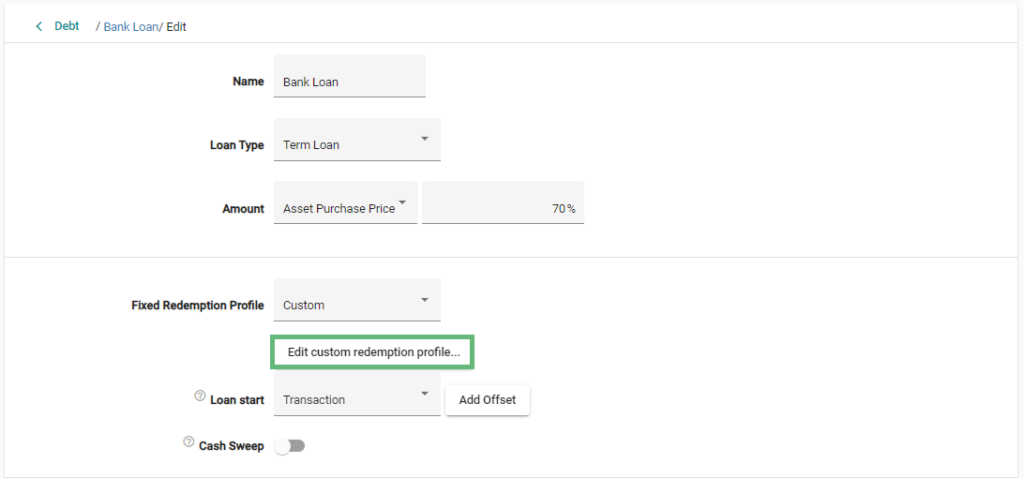

- The redemption profile is now calculated automatically and saved as custom redemption profile. If you want to have a look at the redemption profile, open the debt object in the edit mode and click on “Edit custom redemption profile”.

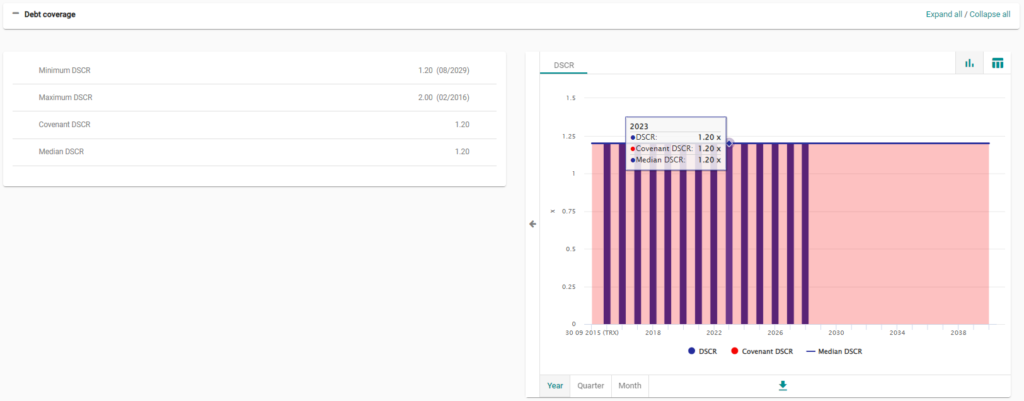

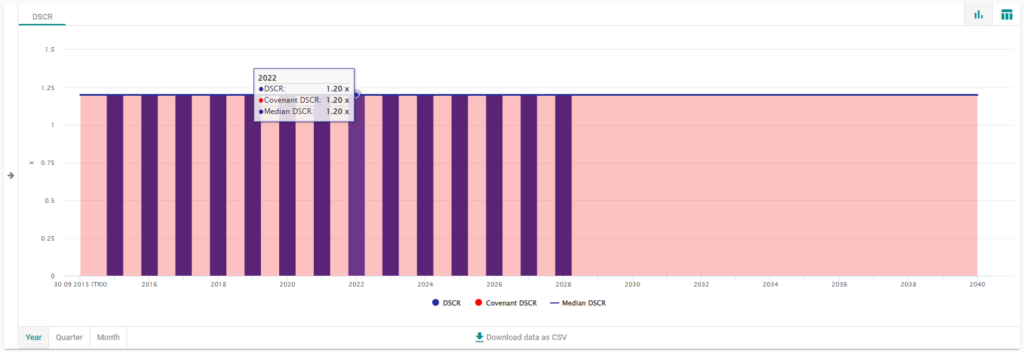

- In the graph area of the “Overview” section you can see the development of the DSCR, which is stable at a value of 1,2 over the debt lifetime.