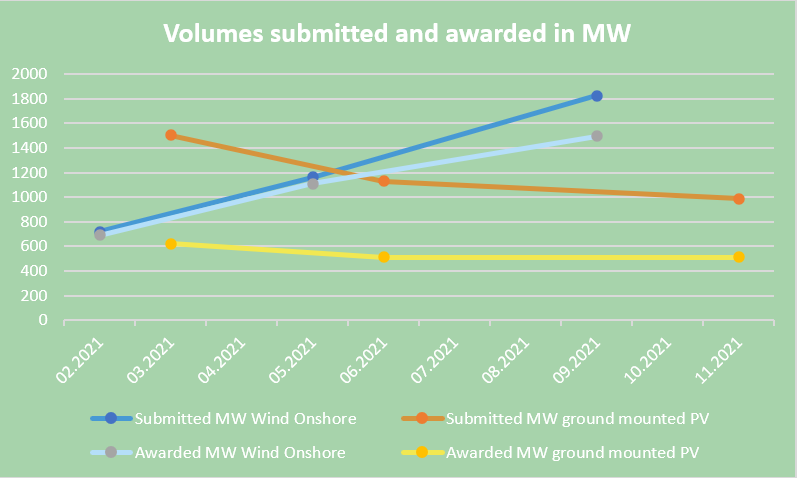

As in the previous year, energy generation by solar plants (data evaluated in 2021 refers to ground mounted pv plants) was oversettled in all three tenders. The results from the previous year were also repeated for onshore wind energy generation: while during the first two tenders less volume was settled than possible, the last tender in 2021 was again oversettled.

Difficult conditions for wind onshore

A total of 4.2 gigawatts of onshore wind was put out to tender this year. Bids were submitted for a total of 3.7 GW, of which 3.3 GW were awarded. The 381 projects that were awarded have an average energy volume of 8.6 megawatts. A particularly large number of surcharges were recorded in Schleswig-Holstein. This is because the north of the state is less densely populated and therefore simplifies compliance with the minimum distance of one kilometre to the next residential area. However, it is not only the minimum distance that makes the realisation of projects more difficult, but also requirements for the protection of species and particularly birds. The restrained bids from the beginning of the year can also be attributed to long processing times, whereby the bids in May already almost coincided with the tendered volume. With the slight oversettlement in September, however, one can speak of a positive trend and it is to be hoped that the trend will continue, even if a larger volume is once again put out to tender in 2022: It amounts to 4 GW, plus additionally the quantity that could not be awarded in 2021. The next bidding dates are set for 1 February, 1 May and 1 September 2022.

Ground mounted PV on the rise

A total of 1.6 GW for ground mounted solar was tendered and awarded this year. The total capacity of the bids was 3.6 GW, almost as high as for onshore wind and thus significantly higher than the quantity tendered. The 331 projects that were awarded provide for an average energy volume of 5 megawatts.

With the increase of the tender volume to 3.6 GW, an alignment of the offered capacity with the capacity to be installed is to be expected in the coming year. Whether this assumption is correct will become clear on the bid dates of 1 March, 1 June and 1 November 2022.

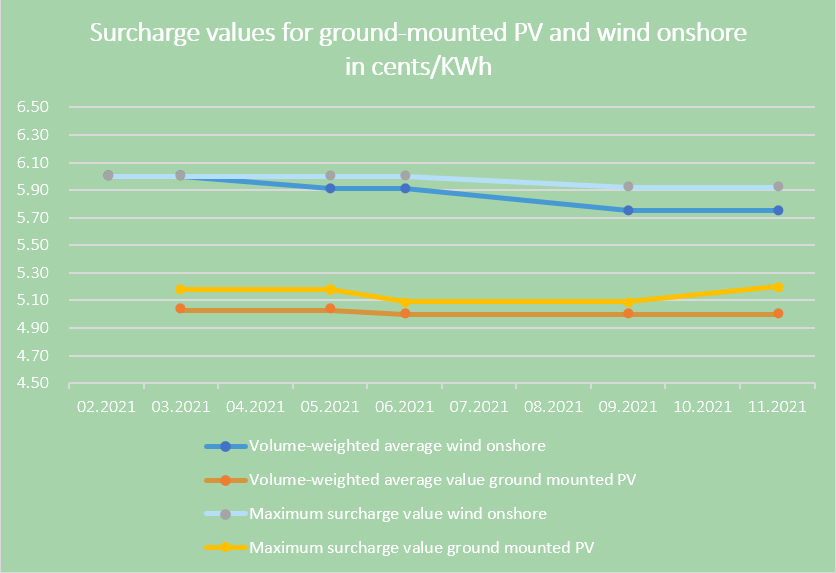

Surcharge values decrease

Compared to the previous year, the average volume-weighted surcharge values for energy generation from onshore wind as well as for ground mounted photovoltaics are decreasing. The average volume-weighted surcharge value in the onshore wind sector was 6.00 ct/kWh due to the significant undersetlement at the beginning of the year. With increasing bids and competition, it fell to 5.79 ct/kWh in September. For ground-mounted solar plants, the average volume-weighted surcharge value fluctuated between 5.03 and 5.00 ct/kWh.

Planned expansion is progressing

At the end of November, it was announced that the new federal government intends to increase the share of electricity generated from renewable energies in gross electricity consumption to 80 percent by 2030, instead of the previous plan to increase the share to 65 percent. Prior to the announcement of the increased expansion target, the EEG stipulated a total output from onshore wind turbines of 57 GW and from solar energy of 63 GW in 2022. In this initial situation, the transmission system operators expected a net increase in RE installations of 8.2 GW, which would again be driven primarily by solar installations. This forecast would fall just short of the EEG’s expansion target. It remains to be seen how the expansion will develop under the new conditions. According to the coalition agreement, faster planning and approval procedures as well as new requirements should create the necessary framework conditions.

EEG levy falls massively

In October, the Federal Network Agency announced that the levy to cover the costs of EEG-subsidised electricity will fall to 3.723 ct/kWh in the new year. Compared to the previous year, the levy will fall by more than 40% and is lower than it has been for ten years. The reason for this is the increased electricity prices on the stock exchange, which ultimately reduce the subsidy requirement.

How will energy production in the renewable sector progress in 2022? The greenmatch team is following developments closely and will keep you informed as usual about further processes and tender results.

Sources:

1 Vgl. Bundesministerium der Justiz und für Verbraucherschutz, Bundesamt für Justiz: Gesetze im Internet. Gesetz für den Ausbau erneuerbarer Energien (Erneuerbare-Energien-Gesetz – EEG 2021). URL: https://www.gesetze-im-internet.de/eeg_2014/__28.html (Stand: 23. Dezember 2021).