In diesem Artikel erfahren Sie, wie Sie Zinszahlungen während der Bauphase thesaurieren können. Dies bedeutet, dass während der Bauphase keine Zinszahlungen fällig werden.

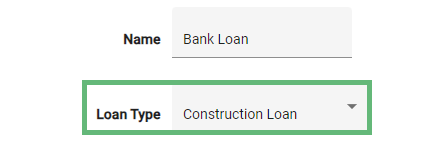

- Erstellen Sie als erstes ein Fremdkapital-Objekt. Hierzu rufen Sie in GM Valuation den Bereich «Finanzierung» auf und klicken im Abschnitt «Fremdkapital» auf «Neu».

- Wählen Sie als Kreditart «Baudarlehen» aus.

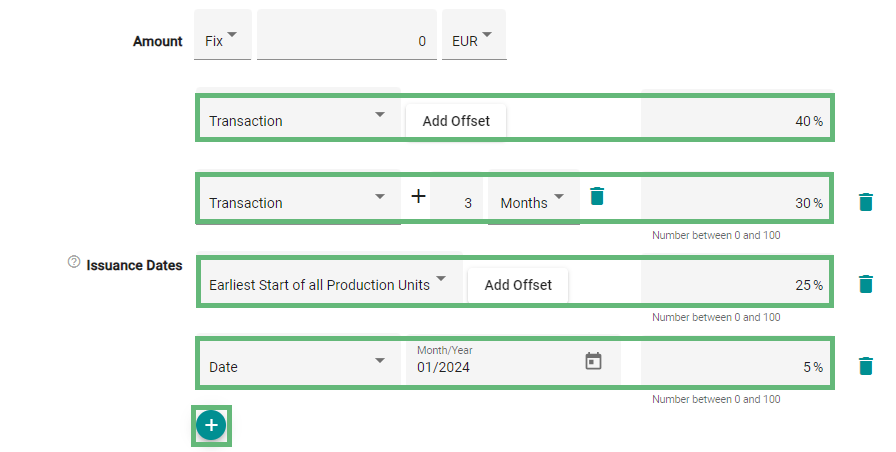

- Beim Input Wert können Sie die Höhe des Baudarlehens festlegen. Anhand des Inputs «Kreditauszahlungen» können Sie bei der Kreditart «Baudarlehen» mehrere Auszahlungsdaten erfassen. Durch das Klicken auf den «+» Button können Sie mehrere Daten hinzufügen.

Ein Datum kann in Abhängigkeit zur Transaktion oder Inbetriebnahme (siehe relative Daten) oder per absolutes Datum erfasst werden. Für alle Daten abgesehen vom ersten legen Sie den Prozentsatz fest, welcher vom gesamten Darlehensbetrag (siehe Wert) ausbezahlt wird. Das erste Datum wird jeweils als Restewert berechnet, so dass die Summe der einzelnen Daten jeweils 100% ergibt.

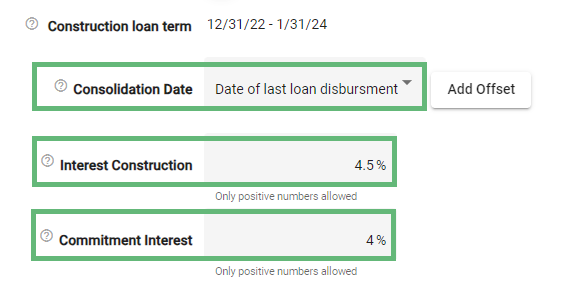

- Das zeitlich letzte erfasst Datum ist standardmässig das Konsolidierungsdatum. Dieses Datum können Sie aber auch anhand des Inputfelds “Konsolidierungsdatum” ändern. Zu diesem Zeitpunkt ist das gesamte Darlehen ausbezahlt. Somit wird das Baudarlehen in ein langfristiges Darlehen umgewandelt. Zwischen dem ersten Auszahlungszeitpunkt und dem Konsolidierungsdatum gelten der Zins Baudarlehen und der Eintrag bei “Bereitstellungsgebühr”. Der Zins Baudarlehen wird auf den bereits ausbezahlten Betrag angewendet und die Bereitsstellungsgebühr auf den noch nicht ausbezahlten Betrag.

Erfahren Sie in unserem Knowledge Center mehr zur Erfassung von Daten: Was sind relative Datumsbezüge und wie kann ich Sie einsetzen?

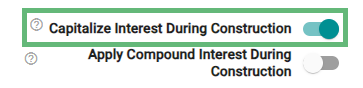

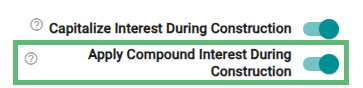

- Aktivieren Sie die Option «Thesauriere Zinsen während der Bauphase». Wenn diese Option aktiviert ist, werden aufgelaufene Zinsen und Bereitstellungsgebühren während der Bauphase (Periode zwischen erstem und letztem Kreditauszahlungszeitpunkt und Konsolidierungsdatum) thesauriert und am Konsolidierungsdatum zum nominalen Darlehensbetrag hinzugefügt. Der finale Darlehensbetrag, bestehend aus dem nominalen Darlehensbetrag zuzüglich der thesaurierten Zinsen und Bereitstellungsgebühren, wird entsprechend dem gewählten Tilgungsmodus getilgt. Folglich werden während der Bauphase keine Zinszahlungen fällig.

Achtung: Diese Option ist nur bei der Kreditart «Baudarlehen» vorhanden.

- Aktivieren Sie die Option «Zinseszinsen während der Bauphase anwenden», falls auf die während der Bauphase (Periode zwischen erstem und letztem Kreditauszahlungszeitpunkt) angelaufene Zinsen Zinsenzinsen erhoben werden.

- Erfassen Sie die restlichen Inputs des Fremdkapital-Objekts. Dies beinhaltet Eingaben zur Tilgung und zum Zins. Anschliessend klicken Sie auf «Speichern» um die Eingaben zu bestätigen.