With Cash Sweeps you are able to use excess free cash flows to pay down outstanding debt and / or shareholder loans.

How do you use Cash Sweeps?

You can use Cash Sweeps for Debt and Shareholder Loan objects.

- Create a Debt object in the “Debt” section or create a Shareholder Loan in the “Transaction” section. If you want to use Cash Sweep for already created objects, click on it and choose “Edit”.

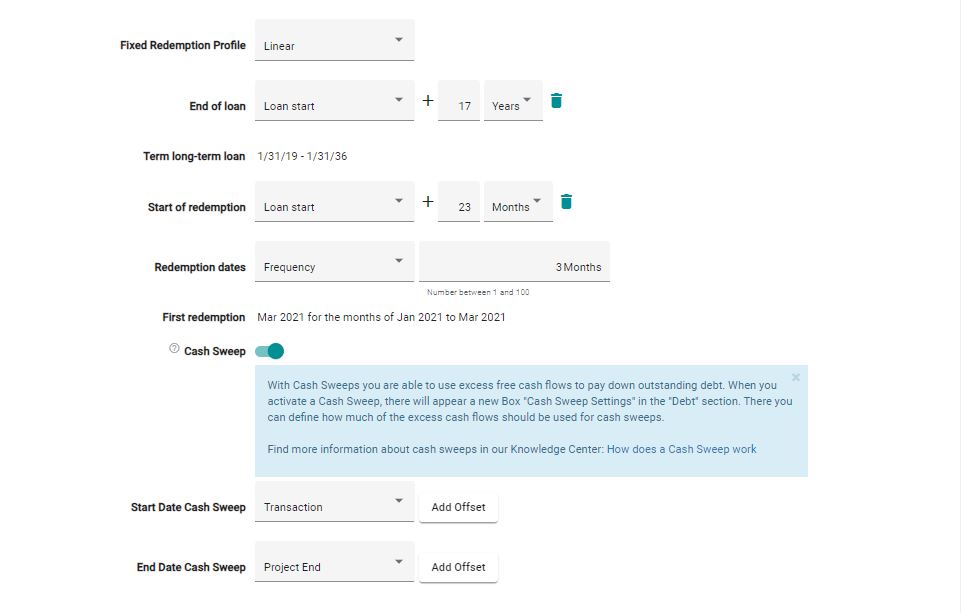

- Enter the parameters like Name, Amount, Issuance Date, Loan Period and Interest. Activate the “Cash Sweep” checkbox (This function is not yet available for the Fixed Redemption Profile “Annuity”).

- When you have activated “Cash Sweep”, you can enter the start- and end date of the cash sweep.

Hint: The cash sweep redemptions take place at the same time as the fixed redemptions.

- Save the object by clicking on “Create” / “Save”.

- In the “Debt” overview you can now edit the Cash Sweep settings: You can set the fraction of the cashflow available for distribution that will be used for additional redemptions of the bank loan or shareholder loan as a cash sweep