In this article you will learn, what “included in asset purchase price” means and what kind of impact this feature has.

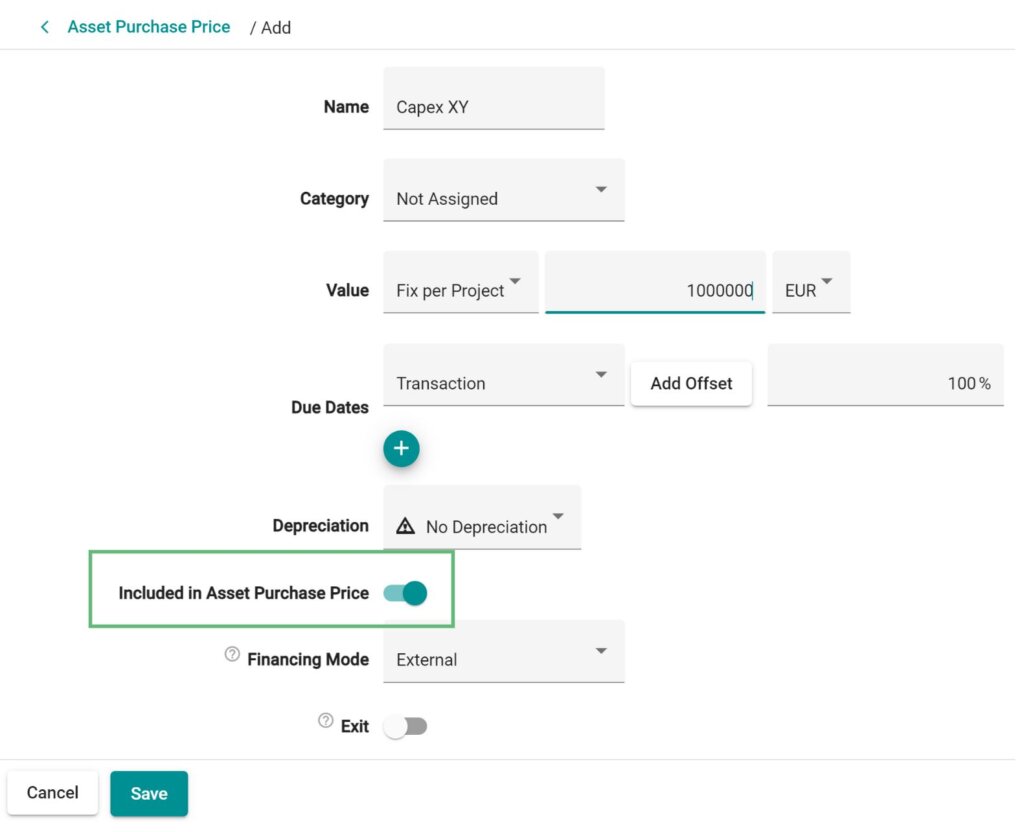

If you add a new Capex item you have the possibility to choose the input field “Included in Asset Purchase Price”.

This feature has an impact on the residual (What is the residual Capex and how is it calculated):

- The residual is reduced if the investment is included in the asset purchase price.

- If the investment is not included in the asset purchase price, it is payable in addition to the asset purchase price. This means that this amount must be paid in addition to the asset purchase price.

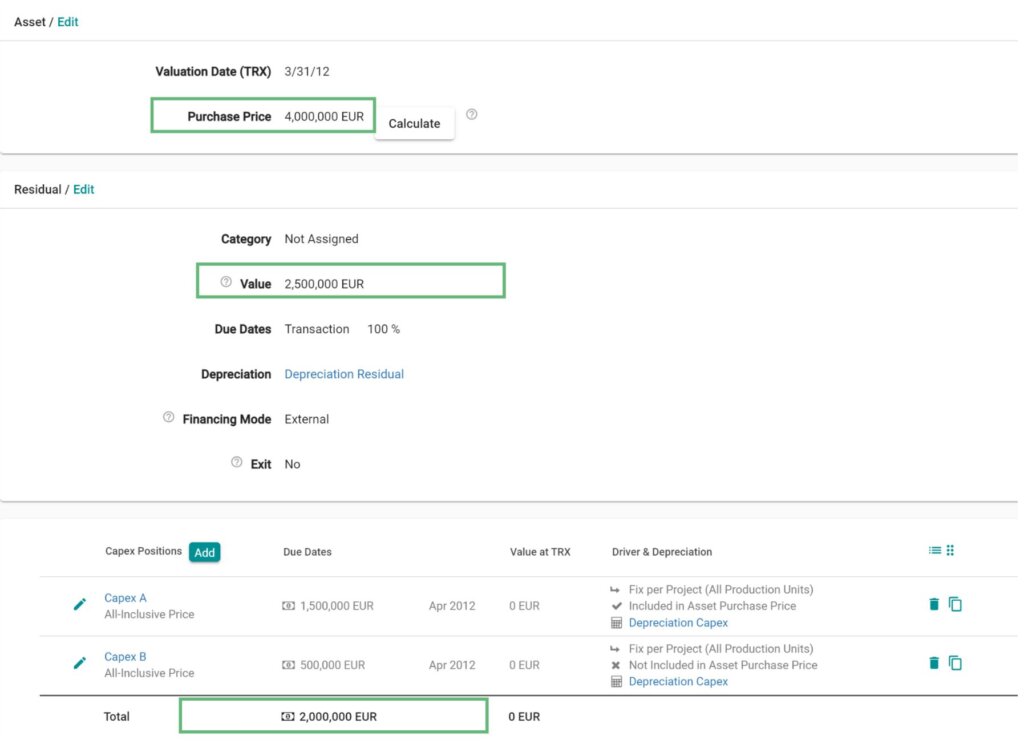

Example: We have an asset purchase price of 4000,000 EUR and two different Capex items, Capex A with an amount of 1,500,000 EUR and Capex B with an amount of 500,000 EUR, thus we have Capex items with a total of 2,000,000 EUR.

Capex B of 500,000 EUR is not included in the asset purchase price and is therefore not included in the residual.

This results in a residual value of 2,500,000 EUR (4,000,000 EUR-1,500,000 EUR). The additional investments of 500,000 EUR are not included in the asset purchase price and must be paid in addition (no effect on residual). Therefore total investments amount to 4,5000,000 EUR